1

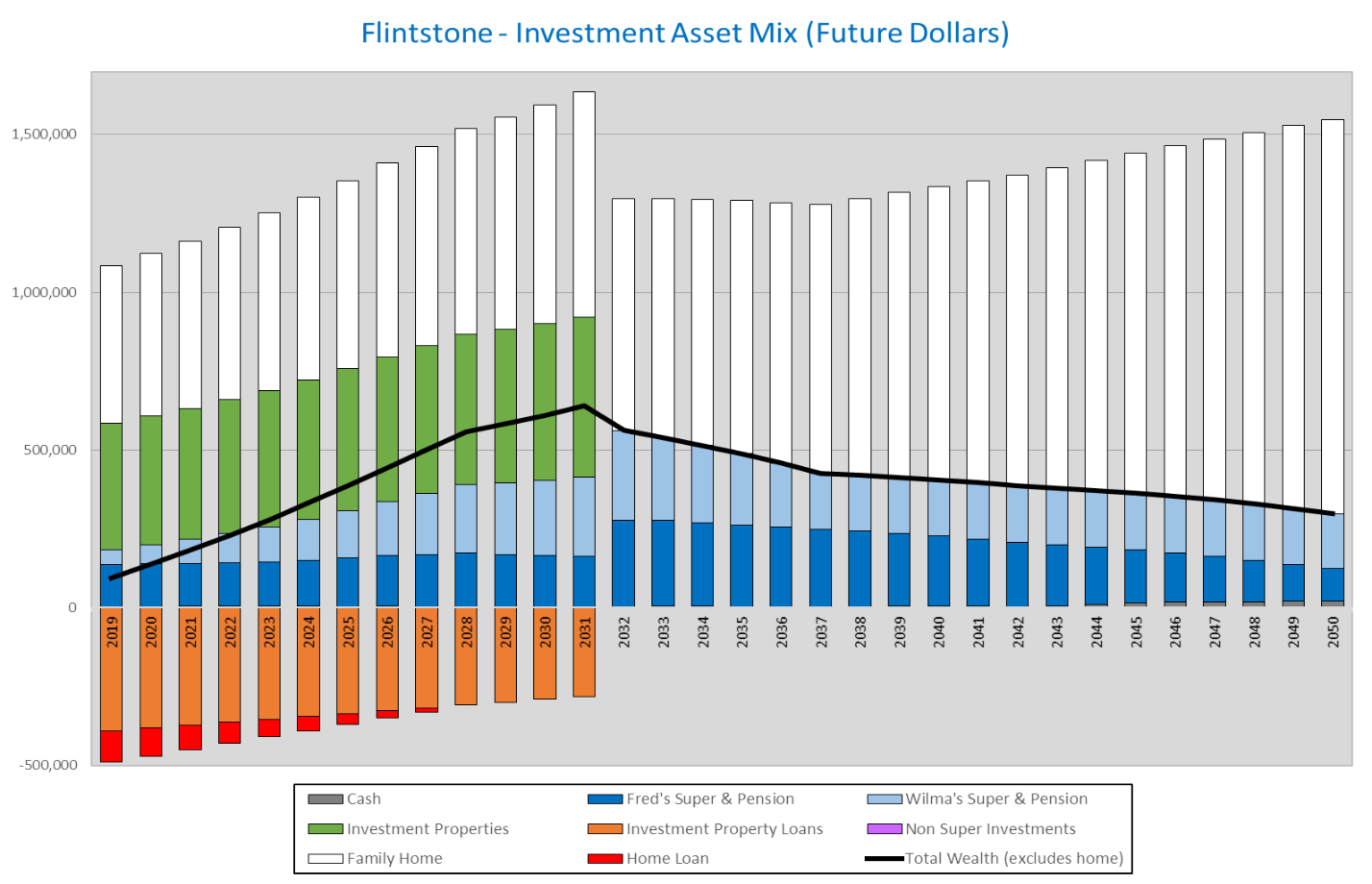

We find out what you earn, what you own and what you owe. With your permission, we will contact your Superannution fund(s) to obtain details of your accounts. We will do the same if you have any personal insurance policies or investments. Once we have a full understanding of your current financial situation, we will use this information as the starting point, and then develop a detailed financial model based on any changes that we recommend from Step 2. This model will show both the composition of your wealth over time and also your sources of retirement income once you do stop work. This information is provided in graphs, examples of which can be found at the bottom of this page.

2

Depending on your situation, there are numerous strategies that we can employ to help get you heading in the right direction. These include:

3

We actively monitor and report your progress towards your goals over time (while making any necessary small tweaks along the way), to make sure that you do reach your financial goals and can then enjoy the comfortable retirement that you deserve. This reporting consists of:

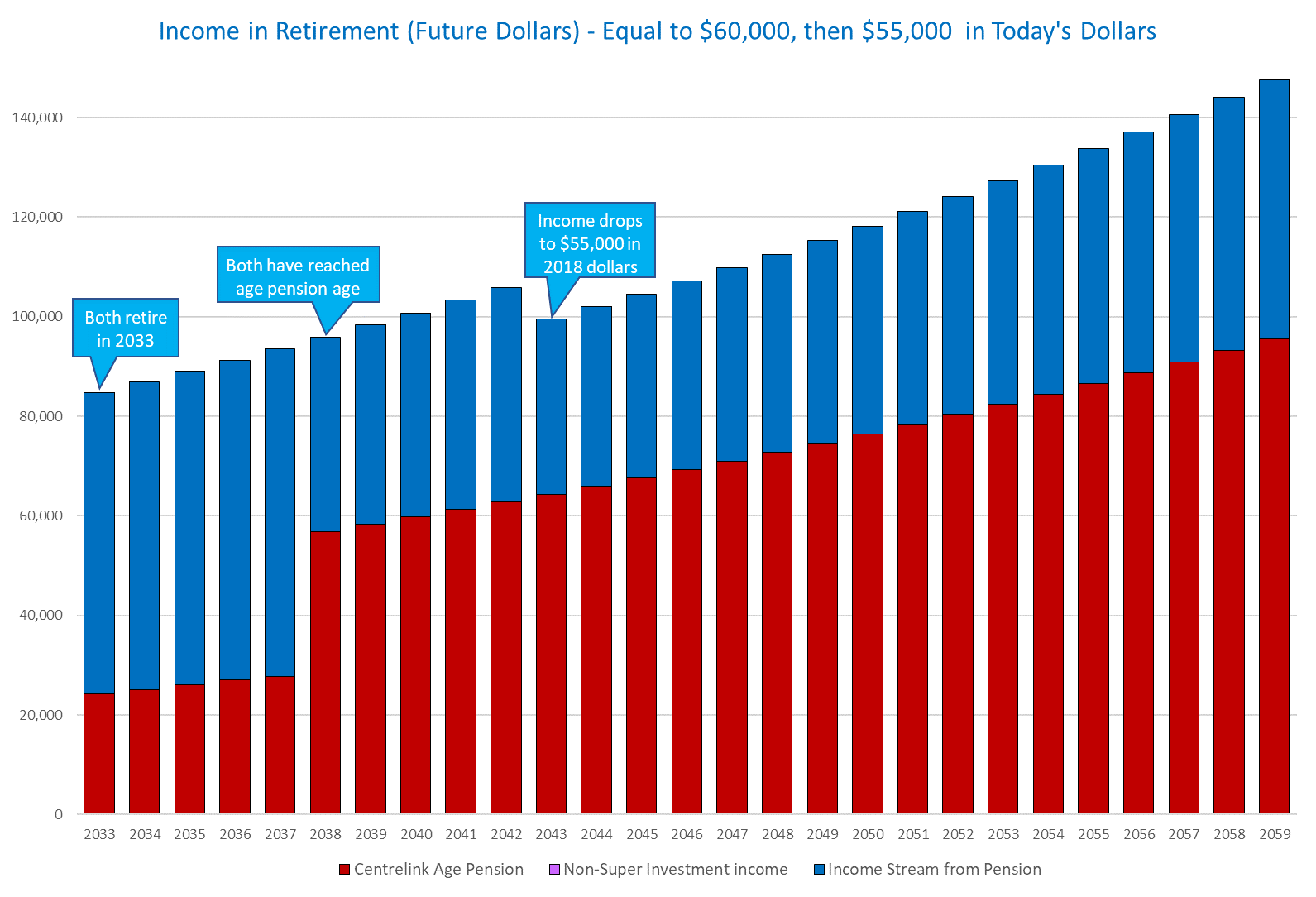

In the graph below, a married couple (Fred and Wilma) retire in 2033. Fred is 67 and is therefore entitled to the age pension from Centrelink. Wilma is 62, and so is not eligible for the Centrelink age pension until 2038. As you can see, their annual income of $60,000 (2018 dollars) is made up from the age pension (red) which is topped up from a pension income stream paid from their own Super (blue). Their income drops to $55,000 (in 2018 dollars) when Fred reaches age 85.

This graph shows the actual predicted composition of their retirement wealth over time. Assets are above the zero point, while debts are below it. The solid black line shows the total “retirement wealth” which includes all their assets minus all their debts but excluding the family home. If you look closely at the graph, you can see the following: